You work hard for your money. Some days, it feels like enough. But Others, it vanishes like mist.

You save, but it’s never enough. You spend—often to keep up or help others. Debt scares you, yet it lingers. You want to invest, but it feels out of reach, like a game for the wealthy.

You’re not alone. And you’re not failing.

The real issue? No one taught you how money truly works—not family, not school, not society.

You mix up income with wealth, savings with security, spending with happiness, debt with defeat, and investing with risk.

This misunderstanding steals your time, peace, and future.

So, ask yourself: Do I really understand the money I’m working so hard for?

THE 5 MONEY MYTHS YOU BELIEVE

We’ve all heard money myths, shaped by family, culture, or social pressure:

“More money will make all your problems vanish.”

“Savings guarantee security.”

“Spending shows people what you're worth.”

“ there's nothing wrong with a little debt. The government is owing way more!.”

“Investing is only for the rich.”

These sound true but mislead. From community expectations to social media trends, they trap us. Earn more, stay broke. Save, lose to inflation. Spend to impress, then regret. Fear debt, miss opportunities. Avoid investing, stay stuck.

How long will outdated beliefs hold back your financial growth?

The Town of the Five Purses

In a small town, five friends each received a leather purse from a wise merchant.

Amari was told: “Fill it with money.” So she worked tirelessly, earning more, but her expenses grew faster. So Her purse stayed empty.

Kwesi was told: “Save everything.” He skipped small joys, filling his purse. Years later, his purse was full—but moldy. The currency had changed. His savings had lost value— inflation eroded its value.

Zoya believed her purse showed her status. She bought new clothes, took photos with it, hopped on trends to impress others, and gave handouts to be praised. Her purse looked great, but was always light. .

Dayo invested in every shiny promise. “Quick returns!” said a loud man in the market. Dayo trusted him—and lost everything.

Noor feared her purse would trap her. She borrowed heavily, avoiding her own. When she finally needed it, she couldn’t find it.

Years later, the merchant returned. “I gave you equal tools,” she said. “But wisdom makes the difference. You all went off on your own, failed to rely on each other's strength. That's why you all failed.”

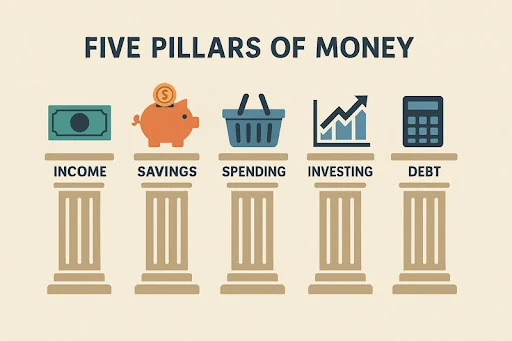

BREAKING DOWN THE 5 PILLARS OF MONEY

Let’s clear the fog.

1ST PILLAR: INCOME is what you earn.

It’s your cash flow—salary, gigs, or market sales. More income gives options, not wealth. Tying it to self-worth leads to burnout or comparison.

2ND PILLAR: SAVINGS is what you keep short-term.

It’s different from emergency savings. It's money set aside for planned goals or purchases, not a long-term fix for every unexpected, unnecessary or unplanned expense.

Where as, emergency savings is money set aside as a safety cushion for things that are detrimental to survival and livelihood. Example; food, an extra year's rent, a new phone or laptop, etc. Emergency Saving or savings without protection against inflation(saving in dollars, crypto, stable assets) can erode it.

3RD PILLAR: SPENDING is what you use money for.

Every purchase reflects choices: needs, wants, or pressures. Social media, family expectations, or status-chasing can drain you. Spending without boundaries is self-sabotage.

4TH PILLAR: INVESTING is how your money grows.

It’s not just for the rich—it’s how wealth is built. Here are examples of beginner-friendly investment strategies:

1. Real Estate Crowdfunding: Raising money with other people to invest in properties (e.g., Fundrise,

risevest). Returns come from rent or appreciation (5-12% annually).

Risk: Property market slumps.

Timeline: 3-7 years. Minimums range from $10-$500.

2. Dividend Stocks: Buy shares in companies (e.g.,

Coca-Cola) that pay regular dividends (2-5% annually). Reinvest dividends for growth.

Risk: Company performance falters.

Timeline: 5+ years. Start with $100 via brokers like Robinhood and $20 via brokers like

Bamboo.

5TH PILLAR: DEBT is borrowed money.

Good debt is Debt used to acquire income-generating assets or investments that increase in value or produce cash flow over time(e.g., mortgages for rental properties, loan to start or expand a business).

Bad debt is Debt used to purchase liabilities or consumables that lose value or generate no income(e.g., high-interest credit cards, loans for cars or luxury shopping).

If loans are scarce, explore local cooperatives or microfinance. Shame hides debt; transparency tames it.

Why does this matter?

Misunderstanding these keeps you:

Earning more, staying broke

Saving, still panicking

Spending, then regretting

Avoiding investing, aging poor

Borrowing, hiding shame

This cycle benefits:

Marketers selling lifestyle

Banks pushing unhealthy credit

Families demanding financial sacrifice

Churches preaching financial ‘blessings’ without literacy

Who suffers? You do. As every generation before you.

A NEW WAY TO RELATE TO MONEY

Treat Your money as a team, not a status symbol. Here's what we mean.

1. Income is the ball, the core resource driving your financial strategy, and how you manage it determines whether you build wealth (scoring through assets) or lose ground (wasting it on liabilities).

2. Savings is the midfielder, the decision-making hub—allocating resources to either grow wealth (assets) or cover lifestyle costs (liabilities), depending on your financial strategy.

3. Emergency Savings is the goalkeeper, blocking emergencies.

4. Spending is the strikers representing the frontline of using money, where the quality of your choices (assets vs. liabilities) determines your financial success

5. Investing is the forward, scoring long-term goals.

6. Debt is the wildcard—use it wisely or get sidelined.

You’re the coach.

Without understanding each role, you’ll lose matches you could win. Remember, You don’t owe anyone your stress or your struggle.

WHAT NOW? MAP YOUR MONEY

1. List all income (salary, gigs, or irregular earnings like market sales).

2. Track all expenses (food, rent, gas, groceries, clothes, etc).

3. Note all debts, even small ones. Adding their deadlines would help you know which debt to prioritize

4. From the definitions used earlier, separate your good debts from bad debts and focus on clearing all bad debts.

5. Savings is like a one time thing. List the things your saving for. Whether assets or liabilities. E g: a new bag, a rental property, a new apartment, etc. So whatever you can spare or the percentage of income you can set aside is down to how bad you want it.

6. Emergency savings is a continuous process(you could say neverending). Though the percentage of income you choose to set aside for emergencies can differ, it's very important because emergencies can come up at any point in time. You don't necessarily need a reason for this one... It's an emergency.

5. Investing: is separate from your savings. This should list all your current investments , their costs and their returns. If you have a rental property, it goes here, if you're thinking of buying a rental property, it goes into savings.

6. Have Fun: small joys matter but also apply a little delayed gratification.

7. Debt repayments should be in affordable, consistent amounts.

8. What type or class of investment interests you. Watch a free YouTube video on it or read Investopedias. Learn more!

9. Start with what you can afford. Test the waters with micro-investing in your desired investment: Use apps like Acorns, Bamboo, Binance, Bybit, Risevest Etc.

10. Learn the difference between high risk-high reward(trading), high risk-low reward(mutual funds), low risk-low reward(USD, real estate) and low risk-high reward(TIPS, Dividends) investments.

11. Research locally: Learn all you can. The good, the bad, best case scenario, worst case scenario, risk, your risk appetite, minimum capital required. Investment costs, management costs, ROI, etc.

12. Set spending boundaries: We know that sometimes we can't resist the urge to get something we don't need. But Before buying it, make sure that it doesn't eat into other money pillars. It's easier to rebuild this way.

13. Practice telling yourself "NOT YET” when you want to buy something you don't really need. This reinforces the faith you have in yourself to achieve your goals.

14. Reframe debt: Before you take that loan or swipe that credit card, Ask: “Will this money work for me or will I end up working for this money”

TAKE ACTION:

Reflect: “Which money pillar am I missing, and how has it affected me?”

Practice saying: “I’m earning to build something better, not just to survive.”

You don’t need that bigger paycheck or another loan just yet. You need clarity.

Money is your tool, not your trap—whether you earn a lot or a little. Start where you are: a single coin saved, invested, or spent wisely can shift your future.

Next time, we’ll explore how family expectations can chain your finances—and how to break free(

be the first to know!).

Till then, What money belief is holding you back? Tradition evolves when you do. Welcome to FatCat Culture.

We'd love to know your thoughts in the comments.

Follow us on social media for amazing updates, finance tips, quotes and more! See you soon 🥰

Comments

Post a Comment

🤝 Hey friend, your voice matters—say hi or share your story below.