- Culture shapes how you think, spend, and save.

- Many beliefs you inherited often prioritize survival over wealth.

- Questioning outdated beliefs isn’t disrespect or betrayal—it’s growth.

- You can honor your roots while building financial freedom.

- Changing your mindset requires awareness and consistent action.

You were raised to believe that wanting more is greedy, helping everyone is noble, and hoping for better is a financial plan. But look around: who did those beliefs make wealthy?

Your parents managed, sacrificed, and hustled—yet many stayed broke, bitter, or burdened by those they once helped. Maybe you’re stuck in the same cycle—earning just enough to survive, pressured to give, afraid to dream big, waiting for God or government.

You’re not lazy. You’re not cursed. You were just taught outdated rules. So let’s ask the real question:

What cultural beliefs are keeping you poor?

Table of Contents

- What Are Cultural Money Beliefs?

- Why They Matter: Real Consequences

- The Psychology Behind These Beliefs

- 5 Harmful Beliefs That Drain Your Wallet

- Guilt, Pressure, and the Path to Freedom

- Self-Assessment: Identify Your Blocks

- Daily Practice: Rewire Your Mindset

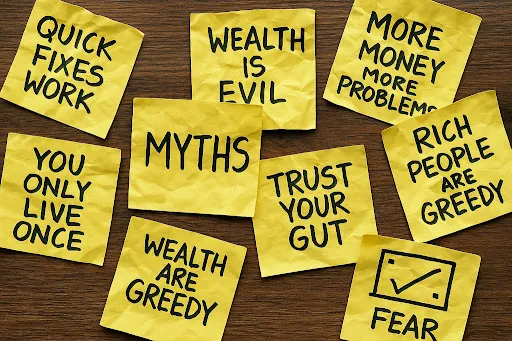

- Common Misconceptions

- Rewrite Your Script

- Tools & Resources to Help You Relearn

- FatCat Glossary

WHAT ARE CULTURAL MONEY BELIEFS?

They’re unwritten rules about wealth passed down through generations:

- “Don’t talk about money.”

- “Give, even if it hurts.”

- “Stay humble—don’t chase wealth.”

- "As long as you're managing, you’re okay."

These sound noble but often limit financial growth. But noble doesn’t always mean wise.

WHY THEY MATTER: REAL CONSEQUENCES

In Nigeria, 63% of people live paycheck to paycheck (World Bank, 2023). In Ghana, 42% of employed youth earn below a living wage (ILO, 2022). In South Asia, millions work long hours yet remain poor (UNDP, 2024).

Why? Cultural rules designed for survival, not wealth keeps people stuck. When you’re taught to fear ambition, wealth or give beyond your means, it stalls your growth.

“Culture should evolve with you, not anchor you.”

THE PSYCHOLOGY BEHIND THESE BELIEFS

Why do we obey beliefs that hurt us?

1. Loss aversion: We fear being labeled selfish, disloyal, greedy or disrespectful.

2. Status quo bias: We copy what we’ve always seen.

3. Guilt conditioning: We feel bad for choosing ourselves or prioritizing others feel "right”.

But Guilt shouldn’t dictate your budget.

What’s one cultural money rule you’ve never questioned?

What’s one common saying about money in your culture you’ve never really questioned?

5 HARMFUL BELIEFS THAT DRAIN YOUR WALLET

1. Money Is The Root Of All Evil

You hear:

- “Rich people are greedy.”

- “Too much money will change you.”

- “Be comfortable with little.”

Impact: You self-sabotage, You downplay ambition and stop aiming higher. Money doesn’t corrupt—it amplifies who you are. Build wealth with integrity.

2. The ‘Big Man’ Syndrome

A wealthy person is expected to fund weddings, burials, school fees, other family events or support EVERYONE.

Impact: Debt, Financial ruin, Constant pressure and Silent resentment. Help when you can, not out of guilt. Say no confidently.

> "If they only respect you when you give them money, it’s not love—it’s leverage."

3. Children Are A Retirement Plan

Many believe children are retirement plans, so they rely on their kids for future wealth and security.

Impact: Over-reliance, Poor financial planning, strained relationships, Guilt-ridden children. Invest in assets and raise independent children, not financial tools.

4. Spend To Impress Culture

Lavish weddings. Giant funerals. Every weekend, another party. This lavish lifestyle is meant to signal success

Impact: Debt and financial instability. Celebrate modestly. Prioritize stability over impressing others.

5. Luck Build Wealth

Waiting for a miracle. Having faith without a plan or taking action.

Impact: Financial passivity, Poor decisions and Missed opportunities. Pray, Plan and act. Belief supports work, not replaces it.

GUILT, PRESSURE, AND THE PATH TO FREEDOM

Chika, earns $5,000 but supports 6 relatives. She’s always tired, broke, and bitter. When she stopped sending money for every request, she was called “stingy.” But now she’s investing—and feels free.

Ravi, Was told to wait, that a job opportunity will show up. He Lost 3 years. He started taking interest in marketing And wanted to sell digital services online, but was made to feel guilty for wanting more. Afraid to upset his parents, he waited another 2 years.

At Last, it took him five years but he finally got the job. His parents were so happy and full of pride, but Ravi silently felt the opposite.

SELF-ASSESSMENT: IDENTIFY YOUR BLOCKS

Ask yourself:

1. Do you feel guilty saving instead of giving?

2. Have you avoided charging for your skill?

3. Do you believe your kids owe you success?

4. Have you ever borrowed to make people view you a certain way?

REWIRE YOUR MINDSET: PRACTICAL STEPS

1. Affirm: “I choose wealth without shame.”

2. Pick a finance book to read daily

3. Track your expenses

4. Say no saying no to non-essential requests.

5. Review spending decisions

6. Pick ONE belief to challenge

7. Say no to unhealthy financial obligations

8. Save or invest a small amount consistently

9. Teach a friend or sibling something you learned

10. Reflect: What belief did I challenge today?

> “You can honor your roots and still grow new branches.”

1. Saying No Is Selfish: Protecting your finances is wise.

2. Faith Is Enough: Faith without work is dead. God honors preparation

3. Wealth Ruins People: Lack of money creates more stress.

4. A Degree Guarantees Wealth: Skills and strategy build wealth.

> "Tradition isn’t wrong—it just needs updating."

REWRITE YOUR SCRIPT

You were taught to survive. Now, you must learn to thrive. You were praised for giving everything and waiting for better days.

But financial freedom comes from multiplying, not just managing. Culture is powerful, but your future is yours. What belief will you break today?

Next up: We’ll expose Why Many People Keep Failing and The Toxic Expectation of Perfection (

Be the First to know!).

Tools & Resources to Help You Relearn

FatCat Glossary

Comments

Post a Comment

🤝 Hey friend, your voice matters—say hi or share your story below.